Most people don’t realize that the pill they pick up at the pharmacy isn’t just chosen by their doctor-it’s also chosen by their insurance company. Behind every prescription is a hidden system called a preferred generic list, a tool insurers use to control costs while still delivering effective care. These lists aren’t arbitrary. They’re built by teams of doctors and pharmacists using hard data on safety, effectiveness, and price. And they’re the reason you pay $5 for a generic blood pressure pill instead of $150 for the brand-name version.

How Formularies Work: The Tiered System

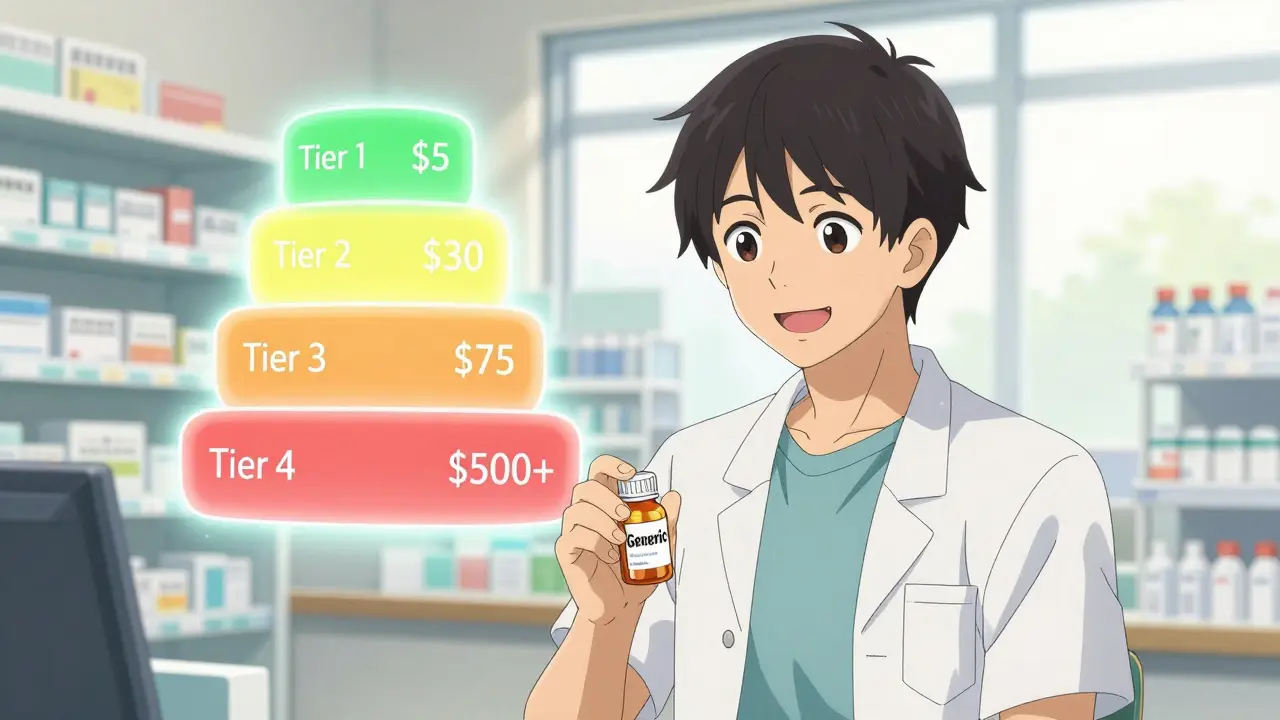

Insurance companies don’t just cover all drugs equally. They organize medications into tiers, like levels in a pricing game. Tier 1 is where preferred generics live. These are FDA-approved copies of brand-name drugs that work the same way but cost 80-85% less. For a 30-day supply, you’ll typically pay $5 to $15 out of pocket. That’s it. No coinsurance. No deductible. Just a flat fee. Tier 2 includes some brand-name drugs and higher-cost generics. Copays jump to $25-$50. Tier 3 is for non-preferred brand-name drugs-think $50 to $100 per prescription. Tier 4? That’s where specialty drugs live: biologics, cancer treatments, rare disease meds. Those can cost hundreds or even thousands, often with coinsurance (you pay a percentage, not a flat fee). Medicare Part D plans almost all use four tiers. Commercial insurers follow the same pattern. In fact, 98% of commercial plans and 100% of Medicare Part D plans use tiered formularies. The goal? Make the cheapest, most effective option the easiest and cheapest for you to choose.Why Insurers Push Generics: The Numbers Don’t Lie

The math is simple. A generic drug with six or more competitors can drop in price by up to 95%. The FDA confirmed this in 2022. When multiple companies make the same drug, they compete. Prices fall. Insurers negotiate directly with manufacturers, not just through middlemen. The result? A $300 brand-name statin becomes a $15 generic. In 2023, generics made up 90% of all prescriptions filled in the U.S.-but only 23% of total drug spending. That’s the power of preferred lists. Pharmacy Benefit Managers (PBMs) like CVS Health, OptumRx, and Evernorth process 5.8 billion prescriptions a year. Eighty-nine percent of those are generics. That’s how these companies save billions. The savings aren’t just for insurers. Patients save too. One Reddit user cut their monthly levothyroxine cost from $187 to $12 by switching to the generic. That’s $2,220 a year saved. GoodRx’s 2023 survey found 76% of patients appreciate the lower costs. But here’s the catch: not everyone knows how to use the system.When Generics Don’t Work: The Exceptions

Not every drug plays nice with generics. Some medications have a narrow therapeutic index-meaning the difference between an effective dose and a dangerous one is tiny. Warfarin, a blood thinner, is one. A 2022 study from the American College of Clinical Pharmacy found 23% of doctors avoid switching patients to generic warfarin because of stability concerns. It’s not that the generic doesn’t work-it’s that even small differences in absorption can throw off a patient’s INR levels. Another problem? Biosimilars. These are the generic versions of biologic drugs like Humira or Enbrel. They’re cheaper, but they don’t come with the same patient assistance programs. Brand-name biologics often offer co-pay cards that reduce your out-of-pocket to $0. Biosimilar makers don’t. So even though Amjevita (the Humira biosimilar) costs less, a patient might end up paying more because they lose their co-pay card. In 2023, 44% of patients on biologics reported trouble switching to biosimilars for this exact reason. And then there’s step therapy. Insurers sometimes require you to try the preferred generic first-even if your doctor says it won’t work for you. The American Medical Association found 42% of physicians report delays in treating chronic pain because of these rules. That’s not just frustrating-it can be dangerous.

Who Decides What Goes on the List?

It’s not the insurance company’s marketing team. It’s a Pharmacy and Therapeutics (P&T) committee. These are independent panels of doctors, pharmacists, and sometimes patient advocates. They review clinical data, cost-effectiveness studies, and real-world outcomes. They don’t just look at price. They ask: Does this drug actually improve health? Is it safe? Are there better alternatives? The FDA requires generics to be bioequivalent-meaning they deliver the same amount of active ingredient into the bloodstream within 80-125% of the brand-name drug. In 2021, the FDA found 98.5% of generic approvals met this standard. So when your doctor says the generic is the same, they’re right. But here’s where things get messy. Sometimes, a brand-name drug and a generic end up in the same tier. That happens in nearly half of all cases. In those situations, your out-of-pocket cost might be the same-$26 for the brand, $23 for the generic. But the insurer still pays $349 for the brand versus $197 for the generic. So even if you don’t save, the system still saves money.What You Can Do: Navigate the System

You don’t have to be passive. Here’s how to take control:- Check your formulary before you fill a prescription. Most insurers have a drug list online. Look for the tier. If it’s Tier 1, you’re getting the best deal.

- Ask your pharmacist if a generic is available-even if your doctor didn’t prescribe one. In 89% of states, pharmacists can swap it automatically unless the doctor says “dispense as written.”

- If your drug isn’t covered or is in a high tier, ask your doctor to file a prior authorization or exception request. According to the Kaiser Family Foundation, 68% of these appeals are approved when backed by medical documentation.

- During open enrollment, compare plans. A drug that’s Tier 1 in one plan might be Tier 3 in another. The Medicare Rights Center estimates you can save $417 per medication just by choosing the right plan.

- Use GoodRx or SingleCare. Even if your insurance doesn’t cover a drug, these apps often show lower cash prices than your copay.

The Future: Where Formularies Are Headed

The system is changing. Starting in 2025, Medicare Part D plans must place biosimilars in the same tier as their brand-name counterparts. That’s a big deal. Right now, only 15% of eligible biologic prescriptions switch to biosimilars in the U.S. In Europe, it’s 85%. This rule could push that number to 45%. UnitedHealthcare already launched “value-based formularies” in early 2024. Instead of just pricing, they now track how well a drug actually works in real patients. If a generic performs better in the real world than a brand-name drug, it moves up the tier-even if it’s more expensive. But there’s resistance. Some PBMs now use “accumulator adjuster” programs. These programs count your co-pay card savings toward your drug costs, but not toward your out-of-pocket maximum. So even if you’re paying $0 thanks to a co-pay card, you’re not getting closer to hitting your annual cap. That’s a loophole that benefits insurers, not patients. By 2030, experts predict formularies will shift from price-based to outcome-based. The question won’t be “Which drug is cheapest?” It’ll be “Which drug keeps patients out of the hospital?”Bottom Line: Generics Are the System’s Backbone

Preferred generic lists aren’t perfect. They can create access barriers. They sometimes ignore patient-specific needs. But they’re also the reason millions of Americans can afford their medications. Without them, drug spending would be unsustainable. The key is knowing how the system works-and using it to your advantage. Don’t assume your doctor’s first choice is the only option. Ask questions. Check your formulary. Talk to your pharmacist. And don’t be afraid to appeal. You’re not just a patient-you’re a participant in your own care.Why do insurance companies prefer generic drugs?

Insurers prefer generic drugs because they are clinically equivalent to brand-name drugs but cost 80-85% less on average. This lowers overall drug spending for the plan and reduces out-of-pocket costs for patients. When multiple generic manufacturers compete, prices drop further-sometimes by over 90%. This allows insurers to keep premiums lower while still providing effective treatment.

What is a preferred generic list?

A preferred generic list is part of an insurance plan’s formulary that identifies which generic medications are covered at the lowest cost. These drugs are placed in Tier 1 of the formulary, meaning patients pay the smallest copay-often just $5 to $15 for a 30-day supply. The list is created by medical experts who evaluate safety, effectiveness, and price.

Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to be bioequivalent to their brand-name counterparts, meaning they deliver the same amount of active ingredient into the bloodstream within a very tight range (80-125%). In 2021, the FDA found 98.5% of approved generics met this standard. Most patients experience no difference in effectiveness or side effects.

Why is my generic drug not covered by insurance?

Your plan may not have included that specific generic in its preferred list, or it might be placed in a higher tier due to pricing negotiations. Some generics are only covered if you’ve tried another one first (step therapy). You can ask your doctor to request a formulary exception or check if a different generic version is covered.

Can I switch from a brand-name drug to a generic?

Yes, if your doctor agrees it’s safe. In 89% of states, pharmacists can substitute a generic unless the prescription says “dispense as written.” Talk to your doctor about switching, then check your plan’s formulary to confirm the generic is covered at the lowest tier. You could save hundreds per year.

What are biosimilars, and why are they treated differently?

Biosimilars are generic versions of complex biologic drugs like Humira. They’re cheaper but don’t come with patient co-pay assistance programs that brand-name makers offer. So even though they cost less, your out-of-pocket might be higher. Insurers are starting to place them in the same tier as the original biologic (starting in 2025 for Medicare), but many still face coverage barriers.

How can I find out which tier my drug is on?

Log in to your insurer’s website and look for the “Drug Formulary” or “Preferred Drug List.” You can also call customer service or ask your pharmacist. Medicare beneficiaries can use the Plan Finder tool. Commercial plans are less user-friendly-many score below average in usability ratings.

What if my doctor says I need the brand-name drug?

Your doctor can file a prior authorization or exception request explaining why the generic won’t work for you-due to allergies, side effects, or medical history. If supported by documentation, these appeals are approved 68% of the time. Don’t assume it’s denied-ask your doctor to fight for it.

Insurers aren’t trying to deny you care. They’re trying to make care affordable-for everyone. The system works best when you understand it. Know your formulary. Ask questions. Advocate for yourself. That’s how you turn a hidden policy into a personal advantage.

Randolph Rickman

December 15, 2025 AT 04:03Generics are the unsung heroes of modern healthcare. I used to think brand-name was better until I switched my cholesterol med and saved $200/month. Same active ingredient, same results, zero difference in how I felt. The system works if you know how to use it.

sue spark

December 16, 2025 AT 23:16I never knew pharmacists could switch generics automatically in most states. That’s a game changer. I’ll ask next time I fill a script. Thanks for laying this out so clearly.

Tiffany Machelski

December 17, 2025 AT 23:22my dr always presribes the brand and i never question it… but now i’m gonna ask. thanks for the nudge. also i had no idea about step therapy being a thing. kinda scary.

Dan Padgett

December 18, 2025 AT 07:56in my village back home, we call this the silent war of pills-where the rich pay more and the poor get the same medicine for pennies. the system isn’t perfect, but it’s the only one we got. i’ve seen people skip doses because they can’t afford the brand. this post? it’s a lifeline.

Hadi Santoso

December 19, 2025 AT 06:13just checked my plan and my thyroid med is tier 1! saved me $180 last month. also, side note: i love how some generics taste weird. like, why does my generic levothyroxine taste like chalk? but hey, if it works, i’ll eat chalk every day.

Arun ana

December 20, 2025 AT 04:49so true!! 🙌 i just switched my blood pressure med to generic last month and my bill dropped from $147 to $8. also, my pharmacist gave me a free sample of the generic before i committed-so cool. thanks for reminding me to check my formulary!!

SHAMSHEER SHAIKH

December 20, 2025 AT 23:04It is imperative to recognize, with the utmost gravity, that the pharmaceutical formulary system-though ostensibly designed for fiscal prudence-is, in fact, a nuanced instrument of equitable access. The tiered structure, meticulously curated by P&T committees composed of clinical experts, ensures that life-sustaining therapeutics remain within the financial reach of the populace. It is not merely an economic maneuver; it is a moral imperative. The FDA’s stringent bioequivalence benchmarks-98.5% compliance-affirm the scientific integrity of generics. Moreover, the absence of co-pay assistance in biosimilars represents a critical lacuna in patient-centered care. One must advocate, persistently and with documentation, for exceptions when clinical necessity overrides cost efficiency. To remain passive is to surrender agency over one’s health. The system is not broken-it is merely underutilized by those who do not interrogate it.

anthony epps

December 21, 2025 AT 15:33wait so if i ask my doctor to fight for the brand, they can actually make it work? i thought it was just a no.